Exploring the nuances of high net worth wealth management versus traditional investing offers a fascinating insight into the tailored strategies required for affluent clients. This discussion delves into the unique financial goals, investment strategies, tax planning, and estate considerations that set high net worth wealth management apart.

The following paragraphs will provide a detailed breakdown of the key differences and considerations that make high net worth wealth management a distinct realm in the world of finance.

Differences in Client Needs

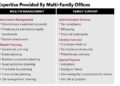

High net worth individuals have unique needs compared to traditional investors due to their substantial wealth. These clients often require more sophisticated financial strategies and specialized services to address their specific goals and concerns.

Complex Financial Situations

- High net worth clients may have complex investment portfolios that include various asset classes such as real estate, private equity, and alternative investments.

- They often have multiple income sources, such as business ownership, investments, and inheritance, which require careful management and tax planning.

Legacy Planning and Wealth Transfer

- High net worth individuals are often concerned with preserving their wealth for future generations and ensuring a smooth transfer of assets to heirs.

- Estate planning, trust administration, and charitable giving are key components of wealth management for this demographic.

Risk Management and Asset Protection

- Protecting wealth from potential risks, liabilities, and market volatility is a top priority for high net worth clients.

- Insurance solutions, asset allocation strategies, and legal structures are essential for safeguarding assets and minimizing risks.

Personalized Wealth Management

- High net worth individuals benefit from personalized wealth management services that are tailored to their specific needs, risk tolerance, and financial objectives.

- Customized investment strategies, tax planning, and retirement planning are crucial for helping these clients achieve their long-term financial goals.

Investment Strategies

When it comes to investment strategies, high net worth wealth management differs significantly from traditional investing. High net worth individuals often require more personalized and sophisticated strategies to preserve and grow their wealth effectively.

Risk Tolerance and Asset Allocation

In high net worth wealth management, risk tolerance levels are typically higher compared to traditional investing. This is because high net worth individuals can afford to take on more risk in pursuit of higher returns. Asset allocation approaches in wealth management are also more diversified and tailored to individual client needs, aiming to minimize risk while maximizing returns.

- High net worth individuals may allocate a larger portion of their portfolio to alternative investments such as private equity, hedge funds, real estate, and venture capital. These alternative investments offer the potential for higher returns but also come with increased risk.

- Traditional investing, on the other hand, often focuses on a mix of stocks, bonds, and mutual funds within a more standardized asset allocation model. The goal is to achieve a balanced portfolio with steady, long-term growth.

Tax Planning and Optimization

Tax planning and optimization play a crucial role in high net worth wealth management, far more so than in traditional investing

Tax-Efficient Strategies

- Utilizing tax-advantaged accounts such as IRAs, 401(k)s, or HSAs to defer taxes on investment gains.

- Implementing strategic charitable giving to reduce taxable income while supporting causes of importance.

- Harvesting investment losses to offset capital gains and reduce overall tax burden.

- Using trust structures or family partnerships to distribute income in a tax-efficient manner.

Impact on Investment Decisions

Tax considerations can significantly impact investment decisions for high net worth clients. For example, the choice between municipal bonds and corporate bonds may be influenced by tax implications. High net worth individuals may also opt for investments with long-term capital gains treatment to benefit from lower tax rates.

Estate Planning

Estate planning for high net worth individuals is a crucial aspect of wealth management that involves a myriad of complexities not typically encountered in traditional investing. It goes beyond simply allocating assets and requires careful consideration of preserving and transferring wealth across generations.

Importance of Preserving and Transferring Wealth

In high net worth wealth management, the focus is not only on growing wealth but also on ensuring that it is protected and passed down to future generations. Estate planning plays a vital role in achieving this goal by establishing mechanisms to safeguard assets and facilitate their smooth transition to heirs.

- Utilization of Trusts: High net worth individuals often utilize trusts as a key estate planning tool to protect assets, minimize tax liabilities, and control the distribution of wealth according to their wishes. Trusts can provide flexibility and privacy in managing assets, allowing for efficient wealth transfer.

- Importance of Wills: While wills are essential for all individuals, they hold particular significance for high net worth clients. A well-crafted will ensures that assets are distributed according to the individual's wishes, avoiding potential disputes among beneficiaries and providing clarity in the estate settlement process.

- Other Estate Planning Tools: In addition to trusts and wills, high net worth individuals may also employ various other estate planning tools such as family limited partnerships, charitable trusts, and gifting strategies to optimize wealth transfer and minimize tax implications.

End of Discussion

In conclusion, the intricacies of high net worth wealth management highlight the importance of personalized approaches, strategic investment decisions, and meticulous planning to preserve and grow wealth for affluent individuals. Understanding these distinctions is crucial for navigating the complexities of managing substantial assets effectively.

Quick FAQs

How do the needs of high net worth individuals differ from traditional investors?

High net worth individuals often have more complex financial goals, requiring personalized wealth management strategies tailored to their specific needs and objectives.

What are some alternative investment options recommended for high net worth individuals?

Alternative investments such as private equity, hedge funds, and real estate are commonly suggested for diversification and higher returns in high net worth wealth management.

Why is tax planning more significant in high net worth wealth management compared to traditional investing?

Given the larger assets at stake, tax-efficient strategies play a crucial role in minimizing liabilities and maximizing returns for high net worth clients.

How does estate planning for high net worth individuals differ from traditional investors?

Estate planning for high net worth individuals involves complex considerations for preserving and transferring wealth across generations, often utilizing trusts, wills, and other sophisticated tools.