Exploring the latest trends in PWM finance that are shaping the landscape of global wealth management provides a fascinating look into the dynamic world of financial professionals. From technological advancements to sustainable investing strategies, this discussion delves into the critical aspects driving the evolution of wealth management practices.

Overview of PWM Finance Trends

Understanding the current trends in Private Wealth Management (PWM) finance is crucial for financial professionals to stay ahead in the ever-evolving landscape of global wealth management. By keeping up-to-date with these trends, professionals can adapt their strategies to meet the changing needs of their clients and maximize investment opportunities.

Impact of ESG Investing on Wealth Management

- The rise of Environmental, Social, and Governance (ESG) investing has significantly influenced wealth management strategies, with investors increasingly looking for sustainable and socially responsible investment opportunities.

- Financial professionals need to incorporate ESG considerations into their investment decisions to align with the values and preferences of their clients.

- Recent developments in ESG reporting standards and regulations have further emphasized the importance of integrating ESG factors into wealth management practices.

Technological Advancements in Wealth Management

- The adoption of advanced technologies such as artificial intelligence, machine learning, and blockchain has transformed the way wealth management services are delivered.

- Fintech solutions have enabled financial professionals to offer personalized investment advice, streamline operations, and enhance client engagement.

- Robo-advisors and digital platforms have democratized access to wealth management services, catering to a broader client base and providing cost-effective solutions.

Global Regulatory Changes Impacting Wealth Management

- Changes in regulatory frameworks, such as tax laws, data privacy regulations, and compliance requirements, have a significant impact on wealth management practices.

- Financial professionals need to stay informed about these regulatory changes to ensure compliance and mitigate risks for their clients.

- The implementation of international tax reporting standards like the Common Reporting Standard (CRS) has increased transparency and cross-border tax compliance in wealth management.

Technology in PWM Finance

The integration of technology in private wealth management (PWM) finance is reshaping traditional practices and enhancing the overall client experience. From advanced analytics to automated processes, technological advancements are revolutionizing the way wealth managers operate.

Role of AI, Machine Learning, and Automation

- AI and Machine Learning: These technologies enable wealth managers to analyze vast amounts of data efficiently, identify trends, and make data-driven investment decisions. By leveraging AI and machine learning algorithms, PWM firms can provide personalized investment strategies tailored to each client's unique financial goals and risk tolerance.

- Automation: Automation streamlines routine tasks such as portfolio rebalancing, trade execution, and reporting, allowing wealth managers to focus more on strategic decision-making and client relationships. This not only increases operational efficiency but also reduces human errors in the wealth management process.

Benefits and Challenges of Integrating Technology

- Benefits:

- Enhanced Efficiency: Technology automates time-consuming tasks, allowing wealth managers to serve more clients effectively.

- Improved Decision-Making: AI and machine learning algorithms provide valuable insights, aiding wealth managers in making informed investment decisions.

- Personalized Services: Technology enables PWM firms to deliver customized solutions that meet the individual needs of their clients.

- Challenges:

- Data Security: With the increasing use of technology, safeguarding sensitive client information from cyber threats becomes a priority for PWM firms.

- Integration Complexity: Implementing new technologies into existing systems can be challenging and may require significant investments in training and infrastructure.

- Client Adoption: Some clients may be hesitant to embrace technology in wealth management, preferring traditional face-to-face interactions with their advisors.

Sustainable Investing in Wealth Management

Sustainable investing has become increasingly important in the world of Private Wealth Management (PWM) finance. Investors are now focusing on incorporating Environmental, Social, and Governance (ESG) factors into their investment decisions to not only achieve financial returns but also make a positive impact on society and the environment.

Impact of ESG Criteria on Investment Decisions

- ESG criteria have a significant impact on investment decisions in wealth management by influencing the selection of companies or assets based on their sustainability practices.

- Investors are increasingly looking for companies that are committed to sustainable practices, ethical standards, and social responsibility, as these factors can contribute to long-term financial performance.

- Integrating ESG criteria into investment decisions can mitigate risks associated with environmental and social issues, while also providing opportunities for long-term growth and value creation.

Successful Sustainable Investing Strategies

- One successful sustainable investing strategy is impact investing, where investors seek to generate positive social or environmental impact alongside financial returns.

- Another strategy is thematic investing, focusing on specific sustainability themes such as renewable energy, clean technology, or healthcare innovation.

- Engagement and active ownership are also key strategies, where investors actively engage with companies to improve their ESG practices and drive positive change.

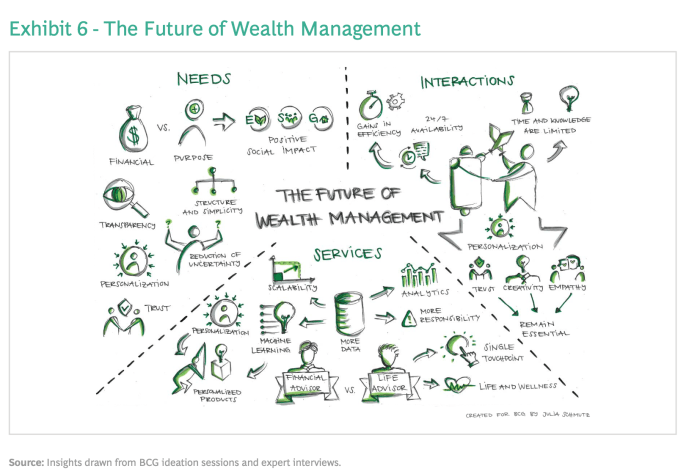

Client Expectations and Personalization

In the realm of wealth management, client expectations are constantly evolving as individuals seek more personalized and tailored financial services. The significance of personalization in delivering these services cannot be understated, as it allows wealth managers to meet the diverse needs and preferences of their clients effectively.

Evolution of Client Expectations

Client expectations in wealth management have shifted towards a more personalized approach, with individuals looking for customized solutions that cater to their specific financial goals and values. This trend has been driven by advancements in technology, which have made it easier for clients to access information and track their investments in real-time.

As a result, wealth managers are under pressure to provide more personalized services to meet these evolving expectations.

Significance of Personalization

Personalization plays a crucial role in wealth management by allowing advisors to tailor their services to each client's unique needs and preferences. By understanding a client's financial goals, risk tolerance, and investment preferences, wealth managers can create customized investment portfolios that align with their objectives.

This level of personalization not only enhances the overall client experience but also helps build long-lasting relationships based on trust and understanding.

Strategies for Meeting Client Needs

Wealth managers employ various strategies to meet the diverse needs of their clients, including conducting in-depth client assessments to understand their financial situation and goals better. By leveraging technology such as artificial intelligence and data analytics, wealth managers can provide personalized investment recommendations and financial planning advice tailored to each client's specific needs.

Additionally, ongoing communication and regular reviews ensure that the client's goals and preferences are continuously taken into account, allowing for adjustments as needed to meet changing circumstances.

Final Conclusion

In conclusion, PWM Finance Trends Shaping Global Wealth Management offers a comprehensive view of the forces at play in the financial industry today. By staying informed and adapting to these trends, professionals can navigate the complexities of wealth management with confidence and innovation.

FAQ Section

How important is it for financial professionals to stay updated on PWM finance trends?

Staying updated on PWM finance trends is crucial for professionals to remain competitive and provide the best services to clients in a rapidly changing landscape.

What role does technology play in shaping wealth management practices?

Technology, including AI and automation, is revolutionizing wealth management by improving efficiency, customization, and access to data for informed decision-making.

Why is sustainable investing gaining traction in wealth management?

Sustainable investing is becoming more important as investors seek to align their values with their financial goals and support companies with positive environmental and social impacts.

How can wealth managers personalize services to meet client expectations?

Wealth managers can personalize services by understanding client needs, preferences, and goals to offer tailored financial solutions and build long-lasting relationships.