As How Wealth Planning Services Reduce Financial Risks for Elite Investors takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

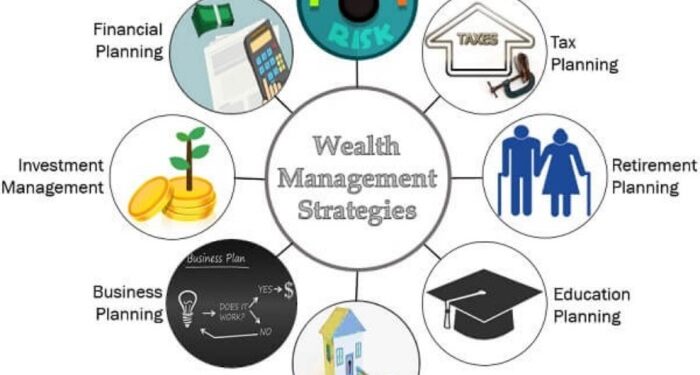

Importance of Wealth Planning Services for Elite Investors

Wealth planning services play a crucial role in tailoring financial strategies for high-net-worth individuals, ensuring that their unique needs and goals are met while minimizing financial risks.

Customized Financial Strategies

Wealth planning services provide elite investors with personalized financial strategies that take into account their specific financial situation, risk tolerance, and long-term objectives. By customizing these strategies, wealth planners can help elite clients maximize their wealth while safeguarding against potential risks.

Risk Mitigation

Wealth planning services are essential for elite investors in minimizing financial risks by diversifying their investment portfolios, creating tax-efficient strategies, and implementing asset protection measures. These services help elite clients navigate complex financial landscapes and make informed decisions that align with their wealth preservation goals.

Estate Planning and Wealth Transfer

Another key aspect of wealth planning services for elite investors is estate planning and wealth transfer. Wealth planners assist high-net-worth individuals in structuring their estates, creating trusts, and developing succession plans to ensure a smooth transfer of wealth to future generations.

These services help elite clients secure their legacy and protect their assets for the long term.

Diversification Strategies in Wealth Planning

Diversification is a crucial strategy in wealth planning that can help reduce financial risks for elite investors. By spreading investments across different asset classes, industries, and regions, elite investors can protect their portfolios from the volatility of any single investment.

Types of Asset Classes for Diversification

- Equities: Elite investors often diversify into stocks of companies across various sectors to mitigate the risk of industry-specific downturns.

- Bonds: Investing in bonds with different maturities and credit ratings can help elite investors balance the risk in their portfolios.

- Real Estate: Including real estate investments in a portfolio can provide diversification and potential income streams outside of traditional investments.

- Alternative Investments: Elite investors may also diversify into alternative assets like private equity, hedge funds, or commodities to further spread risk.

Importance of International Diversification

International diversification plays a crucial role in wealth planning for elite clients. By investing in assets from different countries and regions, elite investors can reduce the impact of local economic downturns or geopolitical events on their portfolios. Additionally, international diversification can provide access to emerging markets with growth potential that may not be available domestically.

Tax Planning and Wealth Preservation

Tax planning plays a crucial role in helping elite investors preserve their wealth by minimizing tax liabilities and maximizing after-tax returns. By implementing tax-efficient strategies, high-net-worth individuals can protect and grow their assets effectively.

Tax-Efficient Investing

Tax-efficient investing is a key component of wealth planning for elite clients. By strategically allocating assets across different accounts and investment vehicles, such as tax-deferred retirement accounts or municipal bonds, investors can reduce their tax burden while optimizing their investment returns.

Utilizing tax-efficient investment strategies allows high-net-worth individuals to make the most of their wealth over the long term.

Common Tax Structures and Vehicles

- Trusts: Establishing trusts can help elite investors protect their assets from estate taxes and creditors while providing for future generations.

- Family Limited Partnerships (FLPs): FLPs allow wealthy families to transfer assets to heirs at a lower tax cost, while also providing asset protection benefits.

- Charitable Remainder Trusts (CRTs): CRTs enable high-net-worth individuals to support charitable causes while receiving income tax benefits and reducing estate taxes.

Estate Planning and Asset Protection

Estate planning plays a crucial role in safeguarding assets for elite investors. It involves creating a comprehensive strategy to manage and distribute wealth in the most efficient manner while minimizing tax liabilities and ensuring the preservation of assets for future generations.

Strategies for Asset Protection

Asset protection is a key component of wealth planning for elite investors. By implementing various strategies, investors can shield their assets from potential risks such as lawsuits, creditors, and other threats. Some common strategies include:

- Setting up trusts: Trusts are legal entities that allow investors to transfer assets to designated beneficiaries while retaining control over the assets. Irrevocable trusts, in particular, provide a high level of asset protection as the assets are no longer considered part of the investor's estate.

- Family limited partnerships (FLPs): FLPs are another effective way to protect assets by allowing investors to transfer assets to family members while maintaining control over the assets. They also provide additional benefits such as estate tax savings and creditor protection.

- Asset protection trusts: These specialized trusts are designed to shield assets from creditors and legal claims. They are often established in jurisdictions with favorable asset protection laws to provide an extra layer of security for elite investors.

Legal Structures for Estate Planning

Elite investors often utilize a variety of legal structures to facilitate estate planning and asset protection. Some common examples include:

- Revocable living trusts: These trusts allow investors to maintain control over their assets during their lifetime and specify how the assets should be distributed upon their death, avoiding probate and ensuring privacy.

- Irrevocable life insurance trusts (ILITs): ILITs are used to hold life insurance policies outside of the investor's estate, providing liquidity for estate taxes and protecting the insurance proceeds from creditors.

- Limited liability companies (LLCs): By structuring assets within an LLC, investors can protect those assets from personal liabilities and potentially reduce estate taxes through valuation discounts.

Ending Remarks

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Detailed FAQs

What are some common risks that elite investors face?

Elite investors often face risks related to market volatility, regulatory changes, and economic downturns. Wealth planning services can help mitigate these risks through tailored strategies.

How can diversification benefit elite investors?

Diversification allows elite investors to spread their investments across different asset classes, reducing the impact of volatility in any single investment.

Why is tax planning important for preserving wealth?

Tax planning strategies can help elite investors minimize tax liabilities and maximize wealth retention over time.

What legal structures are commonly used for estate planning by elite investors?

Elite investors often utilize trusts, wills, and other legal structures to ensure the smooth transfer of assets to future generations.