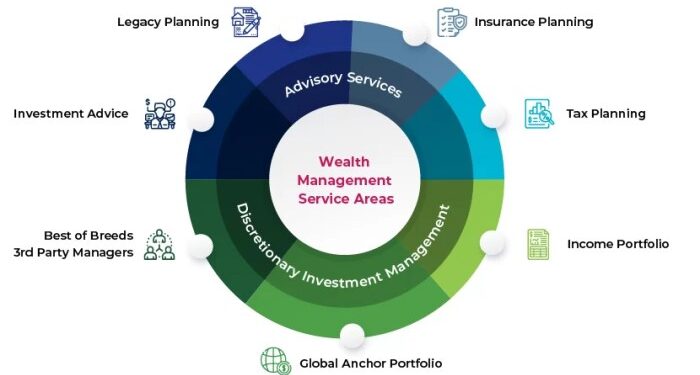

As How Wealth Management Advisors Near Me Handle Complex Portfolios takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Managing complex portfolios requires a delicate balance of understanding, personalization, risk management, and strategic investment decisions. In this guide, we delve into how wealth management advisors near you navigate the complexities of handling intricate portfolios to ensure financial success for their clients.

Understanding Complex Portfolios

Complex portfolios in wealth management refer to a collection of various assets and investments that are diverse and interconnected, requiring specialized knowledge and expertise to manage effectively. These portfolios often involve a high level of risk and can be challenging to navigate due to their intricate nature.

Challenges Associated with Managing Complex Portfolios

- Increased Risk: Complex portfolios typically involve a higher level of risk due to the diverse range of assets and investments.

- Lack of Liquidity: Some assets in complex portfolios may lack liquidity, making it difficult to sell or convert them quickly in times of need.

- Diversification: Balancing the diversification of assets within a complex portfolio to mitigate risk while maximizing returns can be a complex task.

- Regulatory Compliance: Complex portfolios often require adherence to multiple regulations and compliance standards, adding another layer of complexity.

Examples of Assets in Complex Portfolios

- Real Estate Properties: Commercial and residential properties can be part of a complex portfolio, requiring active management and oversight.

- Private Equity Investments: Investments in private companies or ventures can add complexity due to the longer investment horizon and less liquidity.

- Hedge Funds: Including hedge funds in a portfolio can introduce additional risk and complexity due to their alternative investment strategies.

- Derivatives: Complex financial instruments like options and futures can be part of a portfolio, requiring specialized knowledge to manage effectively.

Importance of Personalization

Personalization plays a crucial role in wealth management, especially when dealing with complex portfolios. Tailoring strategies to meet the unique needs and goals of each client is essential for long-term success. Wealth management advisors near you understand the importance of personalized approaches in navigating the intricate world of finance.

Tailoring Strategies for Unique Needs

When it comes to clients with complex portfolios, wealth management advisors go the extra mile to customize their approach. They take the time to understand each client's financial situation, risk tolerance, investment goals, and preferences. By creating personalized strategies, advisors can provide solutions that align with the client's specific needs and expectations.

- Advisors may recommend a combination of investment options based on the client's risk profile and financial objectives.

- They may offer tax-efficient strategies to optimize returns and minimize tax liabilities.

- Advisors can also provide estate planning services to help clients preserve and transfer wealth to future generations.

By tailoring their approach to each client's unique circumstances, wealth management advisors can help individuals achieve their financial goals and secure their financial future.

Risk Management Strategies

Risk management is a crucial aspect of handling complex portfolios, as it helps to protect investments from potential losses. Wealth management advisors employ various techniques to manage risks effectively.

Diversification in Mitigating Risks

Diversification is a key strategy used by advisors to reduce the impact of market volatility on complex portfolios. By spreading investments across different asset classes, sectors, and geographical regions, advisors can minimize the risk of significant losses. This approach helps to ensure that a downturn in one area of the portfolio does not have a catastrophic effect on the entire investment.

- Diversification helps to balance out the risks associated with individual investments, as losses in one area can be offset by gains in another.

- Advisors often recommend a mix of equities, bonds, real estate, and alternative investments to achieve diversification.

- By diversifying, investors can potentially improve their risk-adjusted returns over the long term.

Risk Assessment Tools

Wealth management advisors utilize various risk assessment tools to evaluate the risk profile of complex portfolios and make informed decisions.

One common tool is the Modern Portfolio Theory, which helps to determine the optimal mix of assets to achieve the desired level of return for a given level of risk

.

- Value at Risk (VaR) is another important tool used to quantify the potential losses that a portfolio may face under adverse market conditions.

- Scenario analysis and stress testing are also employed to assess how portfolios would perform under different market scenarios and extreme conditions.

- Risk tolerance questionnaires are used to understand the investor's risk appetite and tailor the portfolio accordingly.

Investment Strategies for Diversification

Diversification is a key strategy used by wealth management advisors to reduce risk and enhance returns in complex portfolios. By spreading investments across various asset classes, industries, and geographic regions, advisors aim to minimize the impact of market fluctuations on the overall portfolio performance.

Asset Allocation

Asset allocation is a fundamental strategy for diversification that involves dividing investments among different asset classes such as stocks, bonds, real estate, and commodities. By spreading investments across various asset classes, advisors aim to balance risk and return based on the client's investment goals, time horizon, and risk tolerance.

- Equities: Investing in stocks of companies across different sectors and market capitalizations can help mitigate risk associated with individual stocks or industries.

- Bonds: Including a mix of government, corporate, and municipal bonds in the portfolio can provide stability and income generation.

- Real Estate: Investing in real estate investment trusts (REITs) or direct property holdings can add diversification and potential inflation protection.

It is important to regularly review and rebalance asset allocations to ensure they align with the client's changing financial goals and market conditions.

Portfolio Hedging

Portfolio hedging involves using various financial instruments to protect the portfolio against potential losses due to market downturns or unexpected events. Strategies such as options, futures, and inverse exchange-traded funds (ETFs) can be used to offset losses in certain parts of the portfolio while allowing exposure to other asset classes.

- Options: Buying put options can provide downside protection for a specific stock or index position in the portfolio.

- Futures: Using futures contracts can help hedge against adverse price movements in commodities, currencies, or interest rates.

- Inverse ETFs: Investing in inverse ETFs can help offset losses in a particular sector or market index by profiting from its decline.

Alternative Investments

Including alternative investments in the portfolio, such as private equity, hedge funds, or venture capital, can add diversification and potentially higher returns compared to traditional asset classes. These investments often have low correlation with the broader market, providing a hedge against market volatility.

- Private Equity: Investing in private companies or funds can offer opportunities for capital appreciation and access to unique investment opportunities.

- Hedge Funds: Allocating funds to hedge funds can provide exposure to sophisticated investment strategies not available in traditional markets.

- Venture Capital: Investing in early-stage companies can offer high growth potential but also higher risk compared to public equities.

Closure

In conclusion, navigating the complexities of complex portfolios requires a deep understanding of the unique needs of clients, personalized strategies, effective risk management techniques, and diversified investment approaches. Wealth management advisors near you play a crucial role in ensuring financial stability and growth for their clients in a constantly evolving market landscape.

Top FAQs

What defines a complex portfolio in wealth management?

A complex portfolio in wealth management typically consists of a variety of assets such as real estate, stocks, bonds, alternative investments, and more, requiring sophisticated strategies for effective management.

How do advisors personalize wealth management strategies for complex portfolios?

Wealth management advisors tailor their approach by understanding the unique financial goals, risk tolerance, and preferences of each client to create customized solutions that meet their specific needs within their complex portfolios.

What are common risk management techniques used for complex portfolios?

Advisors often use techniques like asset allocation, diversification, hedging, and regular portfolio reviews to manage risks effectively within complex portfolios.

Why is diversification important in mitigating risks within complex portfolios?

Diversification helps spread risk across different asset classes, reducing the impact of volatility in any single investment and providing a more stable overall portfolio performance.

Can you provide examples of investment vehicles commonly used in diversifying complex portfolios?

Investment vehicles such as mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and alternative investments like private equity and hedge funds are often employed by advisors to diversify complex portfolios.