Delving into How Multi Family Office Services Help Preserve Generational Wealth, this introduction immerses readers in a unique and compelling narrative, providing an overview of the key benefits and strategies employed by multi family offices. It explores the crucial role these services play in managing complex financial needs for high-net-worth families, setting the stage for a deeper dive into wealth preservation and estate planning.

Introduction to Multi Family Office Services

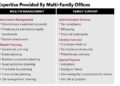

Multi family office services are specialized financial services that cater to the complex needs of high-net-worth families. Unlike traditional financial services, multi family offices offer a comprehensive suite of services tailored to the unique requirements of wealthy families.

Key Benefits of Using Multi Family Office Services

- Personalized Financial Planning: Multi family offices provide customized financial planning strategies to help preserve and grow generational wealth.

- Investment Management: Through skilled professionals, multi family offices offer sophisticated investment management solutions to maximize returns.

- Tax Planning and Estate Management: Multi family offices assist in minimizing tax liabilities and ensuring smooth estate transitions for future generations.

- Risk Management: Multi family offices help mitigate risks through diversification and asset protection strategies.

- Family Governance: These services help establish family governance structures to maintain harmony and continuity in wealth management.

Role of Multi Family Offices in Managing Complex Financial Needs

Multi family offices play a crucial role in managing the intricate financial needs of high-net-worth families by providing a single point of contact for all financial matters. They coordinate various aspects of wealth management, including investments, tax planning, estate management, philanthropy, and family governance, to ensure the preservation and growth of generational wealth.

Wealth Preservation Strategies

Preserving generational wealth is a key priority for multi family offices, which employ a variety of strategies to ensure long-term financial stability for their clients.

Diversification of Assets

One common strategy used by multi family offices is the diversification of assets. By spreading investments across different asset classes such as stocks, bonds, real estate, and alternative investments, families can reduce risk and protect their wealth from market volatility.

Estate Planning

Another crucial aspect of wealth preservation is estate planning. Multi family offices help families create comprehensive estate plans that include wills, trusts, and other mechanisms to ensure a smooth transfer of assets to the next generation while minimizing tax implications.

Risk Management

Multi family offices also focus on risk management to safeguard generational wealth. Through careful monitoring of market trends, assessing potential risks, and implementing appropriate insurance strategies, families can protect their assets from unforeseen events.

Education and Communication

Successful multi family offices emphasize education and communication within the family to ensure that future generations understand the value of the wealth they inherit. By promoting financial literacy and open dialogue about wealth management, families can work together to preserve and grow their assets over time.

Estate Planning and Succession

Estate planning plays a crucial role in preserving generational wealth by ensuring that assets are transferred efficiently and effectively to future generations. Multi family offices offer specialized services to assist high-net-worth families in developing comprehensive estate plans tailored to their unique needs and goals.

Role of Multi Family Offices in Estate Planning

Multi family offices work closely with families to create customized estate plans that encompass various aspects such as wills, trusts, charitable giving, and tax planning. By taking a holistic approach, these offices help families minimize estate taxes, protect assets, and ensure a smooth transfer of wealth to heirs.

- Multi family offices provide guidance on structuring trusts and establishing mechanisms for asset protection.

- They assist in the creation of charitable foundations or trusts to support philanthropic endeavors and leave a lasting legacy.

- These offices work with legal and financial experts to address complex estate planning issues and ensure compliance with relevant laws and regulations.

Succession Planning with Multi Family Offices

Succession planning is a crucial component of estate planning, especially for business-owning families looking to pass down enterprises to the next generation. Multi family offices play a key role in facilitating a smooth transition of assets and leadership within family businesses.

Multi family offices help families identify and groom potential successors, establish governance structures, and implement strategies for seamless leadership transitions.

- They assist in developing family constitutions, outlining roles and responsibilities, and resolving potential conflicts that may arise during succession.

- Through comprehensive succession planning, multi family offices help ensure the long-term sustainability and success of family businesses for future generations.

Investment Management

Investment management is a crucial component of multi family office services aimed at preserving generational wealth. By carefully selecting and managing investments, these offices help high-net-worth families grow and protect their assets for future generations.

Tailored Investment Strategies

Multi family offices work closely with families to create personalized investment strategies that align with their unique financial goals, risk tolerance, and time horizon. These strategies may include a mix of traditional investments such as stocks, bonds, and mutual funds, as well as alternative investments like real estate, private equity, and hedge funds.

By diversifying the investment portfolio, multi family offices help mitigate risk and maximize returns over the long term.

Risk Management Techniques

To safeguard generational wealth, multi family offices employ various risk management techniques. This may involve conducting thorough due diligence on potential investments, monitoring market trends, and implementing hedging strategies to protect against market volatility. Additionally, multi family offices often emphasize the importance of asset allocation and regularly rebalance portfolios to ensure they remain in line with the family's investment objectives and risk profile.

Closing Notes

In conclusion, the discussion on How Multi Family Office Services Help Preserve Generational Wealth sheds light on the significance of these services in safeguarding wealth for future generations. By offering tailored investment management, estate planning, and succession solutions, multi family offices play a crucial role in ensuring a smooth transition of assets and preserving generational wealth effectively.

FAQ Compilation

How do multi family office services differ from other financial services?

Multi family office services are tailored to the specific needs of high-net-worth families, offering comprehensive solutions that go beyond traditional financial services to address complex wealth management requirements.

What are some common strategies employed by multi family offices to preserve generational wealth?

Multi family offices often utilize a combination of investment diversification, tax planning, and asset protection strategies to preserve generational wealth effectively.

How do multi family offices assist in developing comprehensive estate plans for wealth transfer?

Multi family offices work closely with families to create detailed estate plans that consider tax implications, asset distribution, and long-term wealth preservation goals for a seamless transfer of wealth to the next generation.